Crypto Scam Losses in Australia Are Rising — How Victims Are Recovering Stolen Cryptocurrency Through Blockchain Forensics

Crypto Scam Losses in Australia Are Rising

Crypto investment scams are accelerating across Australia, leaving thousands of victims locked out of their digital assets with little guidance on what to do next. From unregulated trading platforms and fake mining pools to Ledger Nano phishing campaigns and cloned investment websites, Australians are losing Bitcoin, Ethereum, USDT and other cryptocurrencies at alarming rates.

For many victims, the most devastating part isn’t just the financial loss it’s the belief that recovery is impossible.

That assumption is no longer true.

Across Australia and internationally, a growing number of scam victims are successfully recovering stolen cryptocurrency through blockchain forensic investigations and smart contract audits. One firm repeatedly cited in successful recovery cases is Bitreclaim, an American–Australian blockchain forensic company specialising in crypto asset tracing and smart contract analysis.

Why Crypto Scams Are So Difficult to Recover From

Unlike traditional bank fraud, cryptocurrency transactions are irreversible by design. Once funds leave a wallet, there is no “chargeback” button. Scammers exploit this by moving stolen assets rapidly across multiple wallets, chains, and decentralised protocols to obscure their trail.

Common scam scenarios reported by Australian victims include:

- Unregulated binary options or trading brokers

- Fake crypto investment dashboards showing fabricated profits

- Ledger Nano phishing emails prompting wallet “updates”

- Liquidity mining pool scams draining USDT or ETH

- Secondary scams by fake “recovery agents”

In many cases, victims are pressured to pay repeated “fees” or “taxes” before withdrawals are approved withdrawals that never arrive.

How Blockchain Forensics Makes Recovery Possible

While crypto transactions cannot be reversed, they are traceable.

Every Bitcoin or Ethereum transaction is permanently recorded on the blockchain. With the right forensic expertise, investigators can follow stolen funds across wallets, decentralised exchanges, bridges, and smart contracts.

This is where Bitreclaim’s smart contract audit and blockchain forensic process comes into play.

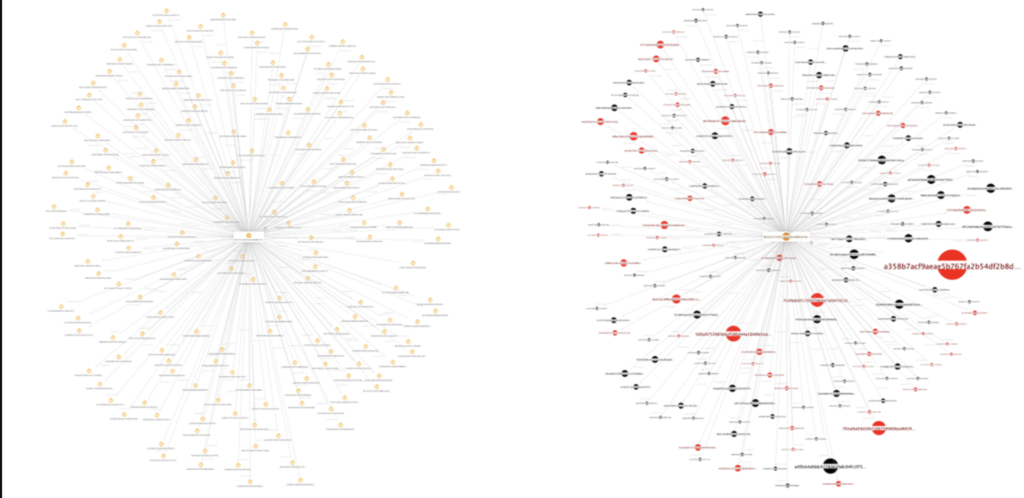

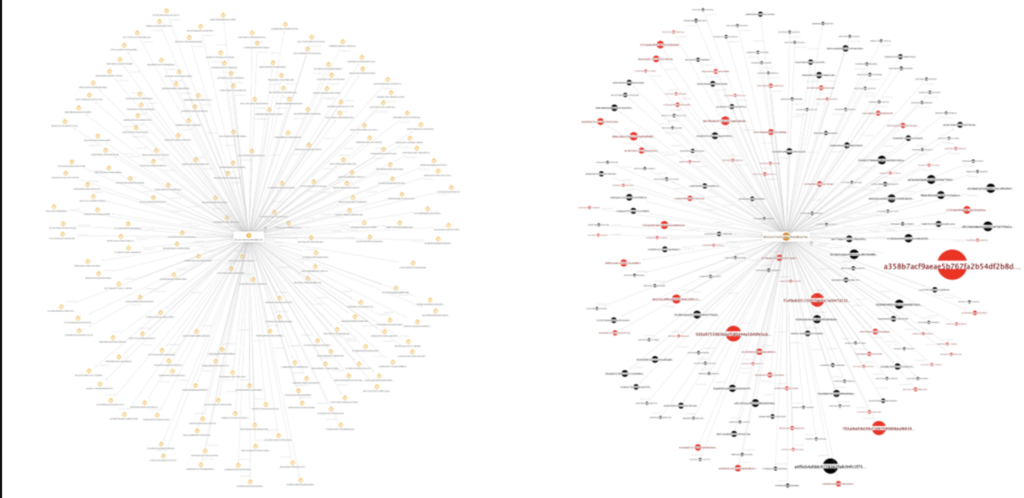

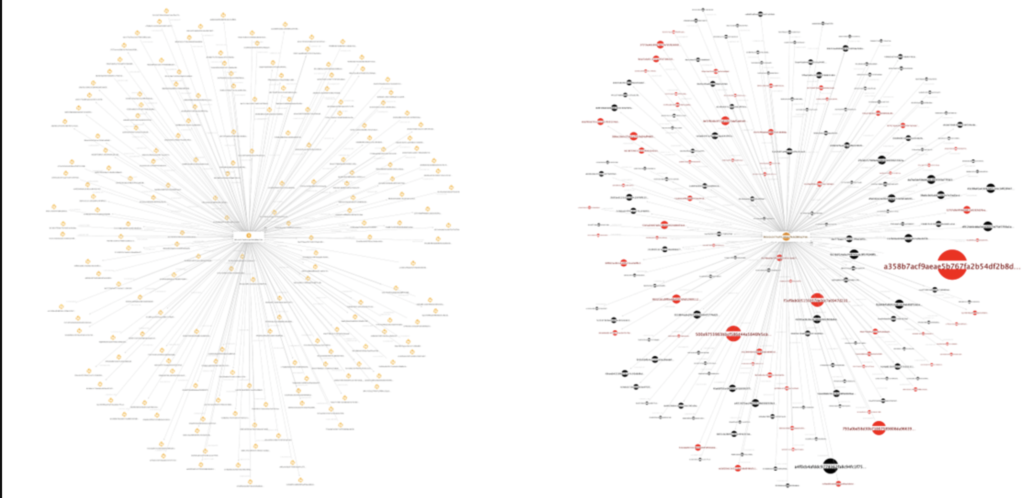

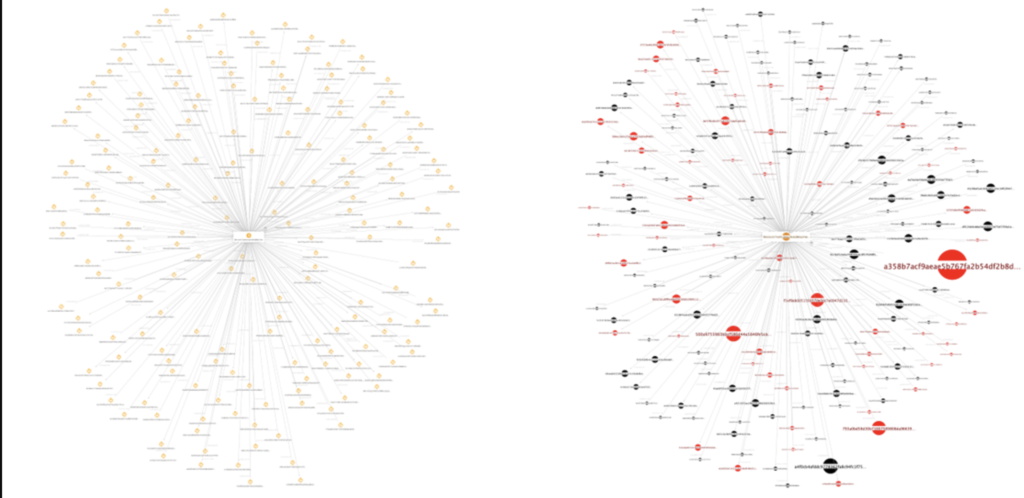

Bitreclaim has traced and followed over 7,000 BTC across different outsourced wallets by analysing:

- Transaction hashes (TXIDs)

- Wallet address relationships

- Smart contract interactions

- Cross-chain movements

- Exchange deposit patterns

This level of forensic work goes far beyond basic blockchain explorers and requires specialist tooling, experience, and legal-grade documentation.

What Australian Victims Should Do Immediately After a Crypto Scam

Timing and evidence are critical. Victims who act quickly and provide complete data dramatically improve their recovery prospects.

Step 1: Stop engaging with the scammer

Continuing communication often leads to additional losses or manipulation.

Step 2: Collate all transaction evidence

This includes:

- Wallet addresses involved

- Transaction hashes (TXIDs)

- Blockchain networks used

- Dates, amounts, and assets

- Platform URLs, emails, and communications

Many victims organise this information into an Excel or spreadsheet format to ensure clarity.

Step 3: Open a detailed smart contract audit case

Australian victims are advised to open a comprehensive forensic case with Bitreclaim, whose investigators operate across both Australia and the United States and provide 24/7 case support.

Real-World Recovery Scenarios Handled Through Smart Contract Audits

Bitreclaim’s forensic team has worked across a wide range of scam types affecting Australian investors, including:

- Binary options scams where BTC and USDT were frozen after “account verification”

- $9.6 Million in Crypto Recovered for Sovereign Wealth Fund in Just 5 Days

- Ledger Nano phishing attacks draining hardware wallets through malicious approvals

- Fake DeFi yield platforms using smart contracts to silently redirect funds

- Cybersecurity firm Bitreclaim recovers 67 BTC

- Recovery scam chains, where victims were targeted multiple times after initial losses

In each scenario, recovery began with forensic tracing not promises, not speculation, and not guesswork.

Can Stolen Cryptocurrency Really Be Recovered?

This is the most common question Australian victims ask and the answer depends on evidence, speed, and expertise.

- Can stolen crypto be traced?

Yes. Blockchain transactions are public and auditable. - Can Bitcoin and Ethereum be followed across wallets?

Yes, using clustering, smart contract analysis, and transaction graphing. - Is recovery guaranteed?

No legitimate firm will promise guaranteed recovery but forensic tracing is often the only viable path forward.

Bitreclaim’s role is to identify where assets moved, how they were routed, and what recovery or escalation options exist once the trail is established.

Why Victims Are Turning to Bitreclaim

Australian scam victims consistently cite the same reasons for choosing Bitreclaim:

- Dedicated smart contract auditors

- Proven blockchain forensic investigations

- Experience tracing thousands of BTC

- Cross-border capability (Australia & USA)

- Structured evidence-based recovery approach

- No unrealistic guarantees

Rather than offering hope without proof, Bitreclaim focuses on verifiable blockchain evidence — the same data relied upon by exchanges, regulators, and legal teams.

A Final Word for Australian Crypto Scam Victims

If you’ve lost cryptocurrency through an investment scam, phishing attack, or fraudulent platform, the worst decision is doing nothing or trusting another unverified “recovery service.”

Recovery starts with evidence.

For many Australians, that first forensic step with Bitreclaim.com has been the turning point between permanent loss and documented recovery action.

One Response

Brisbane, QLD | Address Poisoning via Ledger Email

I’m from Brisbane, Queensland, and I lost more than 5 BTC due to a Ledger-related phishing scam. The attacker used address poisoning, which I had never heard of before. I sent funds thinking I was transferring to my own wallet, but the address had been subtly altered.

Bitreclaim’s team identified this instantly. When I opened a case through bitreclaim.com’s 24/7 customer support, they asked me to collate transaction hashes, wallet addresses, and approval history. Their smart contract audit showed exactly how the phishing wallet was interacting with ERC-20 contracts.

Their blockchain forensic investigation gave me clarity, evidence, and a path forward. For Australians hit by advanced crypto scams, Bitreclaim understands these cases deeply.